Apple (Nasdaq: AAPL) is having a rough time with dwindling iPhone demand, along with the persistent supply-chain constraints. Inflation, the continuing pandemic, and the unpredictable economy may possibly be affecting the demand for iPhones.

Moreover, iPhone users are not finding anything too special about the new model to entice them to upgrade. In fact, Apple co-founder Stephen Wozniak himself said that the iPhone 13 isn’t much different from the iPhone 12.

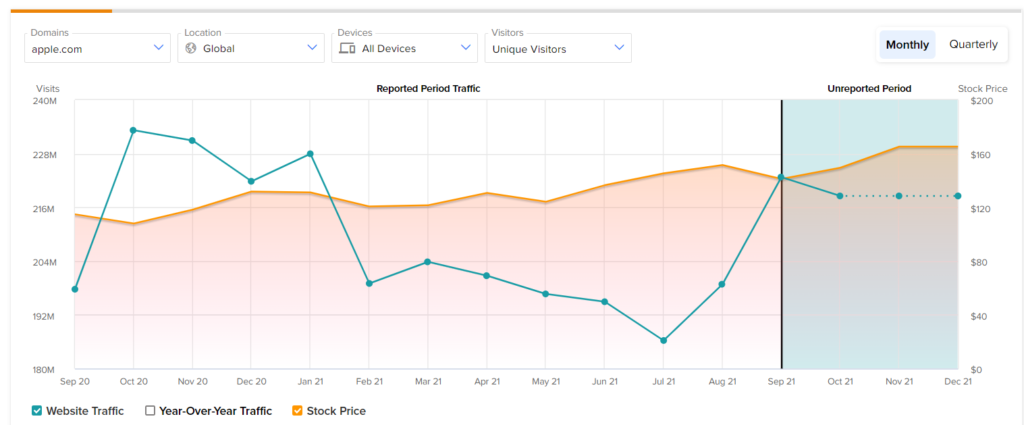

Falling Website Traffic Trends

A 1.89% sequential drop in unique virtual visits to the Apple website in the month of October after a two-month rally reflects the demand decline. We found this trend on TipRanks’ Website Traffic tool, which derives a company’s website traffic volume from data sourced from Semrush (SEMR).

Nonetheless, the price of the AAPL stock hasn’t been affected by the iPhone demand decline, and has rallied 5.87% in October as compared to September. This is possibly because Apple is one of the most fundamentally and financially strong global tech titans.

Strong Financial Position

Apple’s strong balance sheet and cash flow generating capabilities are remarkable. As of September 25, cash & marketable securities were at about $191 billion, and total debt at about $125 billion, leaving the company with net cash of $66 billion.

Furthermore, the company returned $24 billion to shareholders in the fiscal fourth quarter, through dividends and share repurchases.

Such solid liquidity helps Apple smoothly pursue growth-boosting initiatives like acquisitions and technological innovations. Also, the ability to increase shareholders’ value makes the AAPL stock attractive for investors.

Focus on the Future

Apple is a forward thinker, as demonstrated by its growing focus on developing autonomous vehicles and augmented reality/virtual reality (umbrella term being XR) technologies. These rapidly emerging areas present lucrative growth opportunities for the long haul.

Importantly, Apple has ramped up its efforts in this direction by acquiring small tech firms dealing in AR hardware, 3D gaming, machine learning, and VR software, like SensoMotoric, Flyby Media, Emotient, TupleJump, Turi, etc. Moreover, Apple’s AR platform —ARKit— helps developers to build AR experiences for the iOS platform.

Experts’ Opinion

Yesterday, Bernstein analyst Toni Sacconaghi weighed in on the factors that might influence the AAPL stock, and decided to reiterate a Hold rating, taking into account the poor iPhone demand and the fact that demand might further decline with the rise of XR devices.

However, he was upbeat about the company’s focus on the future of technology, from eye-tracking to VR headsets. This is because he believes that XR devices will most likely snatch away the demand for iPhones altogether, eventually, preferring them over iPhones to access mobile internet.

“We are generally believers – and while the metaverse’s ultimate timeframe and capability is still murky, history has shown that transformative innovation often occurs on its second or third iteration,” he opined, discussing the prospects of the metaverse (a futuristic virtual reality experience). He added, “We believe there is room for an XR device and iPhone to coexist in the medium-term, but that over time, XR devices could ultimately come to replace some or much of the functionality of smartphones.”

The Wall Street analyst consensus, however, is more positive about the AAPL stock than Sacconaghi, with a Strong Buy rating, based on 22 Buys, 5 Holds, and 1 Sell. The average Apple price target of $169.96 indicates an upside potential of 2.81%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclosure: At the time of publication, Chandrima Sanyal did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >