Billionaire Investor Howard Marks (Trades, Portfolio) has a book called “Mastering the Market Cycle." In the book, he writes about how the market moves in cycles from extreme optimism to pessimism, like a pendulum. Thus, one strategy to try and outperform the market is to buy and sell at the extremes of a stock's movement.

Guru Robert Rodriguez has averaged more than 15% per year during the past 20 years. One of his winning strategies is to buy stocks "on or close to being on the new 52 week low list."

Tech stocks are certainly in a cyclical downswing in this high inflation, rising interest rate environment, so it might be time for investors to look for value in this sector. Thus, here are two of my favorite software-as-a-service (SaaS) stocks which are trading close to 52-week lows.

1. Salesforce

52-week low: $155

Stock price: ~$164

From highs of $311 per share reached in late 2021, Salesforce (CRM, Financial) has seen its stock drop by 48%. The stock dropped as low as $155 but has since recovered by 5%.

Salesforce is a pioneer in customer relationship management software. This is basically a big database which companies use to hold all of their customers' details. But the special thing about Salesforce is that its platform can do a whole lot more for sales teams, from “lead scoring” potential customers who are most likely to buy and even setting up automated alerts for marketing and sales people. Today, over 150,000 companies use Salesforce, and they still have the number one CRM platform by revenue market share, despite increasing competition in the industry.

The company's three-pronged strategy for growth includes:

Land and expand

Multi cloud adoption

International expansion

Salesforce offers a multitude of platforms (CRM, Sales, Marketing, Service), which makes it easier to upsell to enterprise customers. Management has been consistently executing the strategy well, with multi cloud adoption jumping from 92% of annualized recurring revenue in 2020 to 95% by 2022.

Salesforce announced strong earnings in the most recent quarter. Despite being a monster with a $180 billion market cap, it still reported first quarter revenue of $7.41 billion, up 24% year over year. Operating cash flow was $3.7 billion, up 14% year over year.

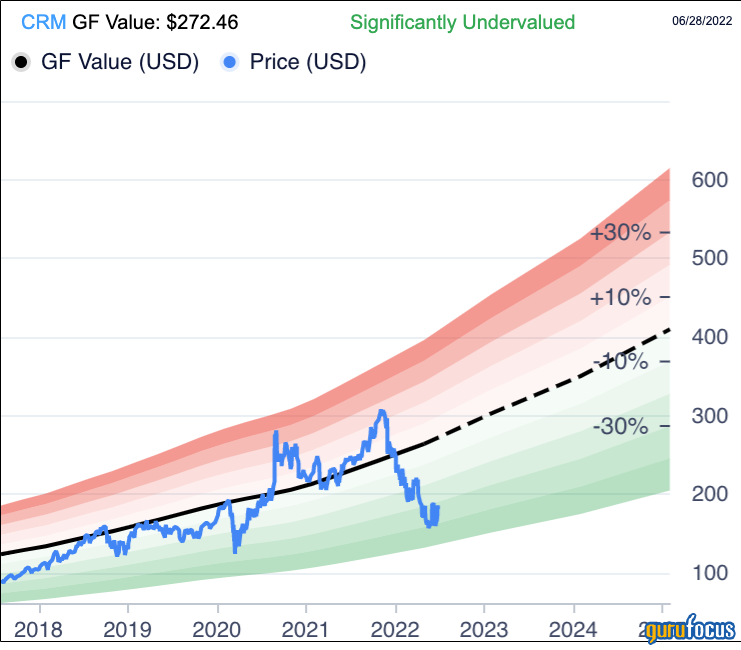

In terms of Valuation, the GF value line indicates the stock is significantly undervalued.

2. SAP

52-week Low: $89

Stock price: ~$90

SAP is a German multinational software company and is the largest company in Germany by market capitalization. It employs over 100,000 people and has over 425,000 customers globally. It is most famous for its Enterprise Resource Planning software which helps businesses view and manage business resources such as cash, inventory, production capacity, etc. while also allowing them to gain insights into purchase orders, payroll and much more.

SAP reported strong financial results for the first quarter of 2022, with total revenue of 7.07 billion Euros ($7.36 billion), up 11% year over year. Cloud revenue accelerated by 31%. with the S/4 HANA cloud product revenue popping by 78%.

Earnings per share did decline by 29%, which was a negative sign, and the company is expecting the exit from Russia to result in a €300 million revenue hit and negatively impact operating profit by €350 million. The good news is that the company is forecasting EPS to bounce back in full-year 2022. In fact, it recently raised its 2022 EPS estimates to €4.05 per share. The dividend yield is currently at 1.63%, and SAP plans to focus on decreasing debt between 2023 and 2025.

In terms of valuation, the GF Value line indicates the stock is modestly undervalued.