It’s not every day that the weather can impact the stock market, yet here, it just did. Discount retail chain Dollar Tree (NASDAQ:DLTR) recently saw shares slip fractionally after reports noted its distribution center in Oklahoma was destroyed.

The storm that took the Dollar Tree distribution center with it was also responsible for the deaths of five people in Oklahoma and billions of dollars in damage. Dollar Tree’s distribution center, located in Marietta, is one of just 15 such centers Dollar Tree operates, which means a substantial portion of its inventory and fulfillment systems was just wiped out.

That, noted Truist analyst Scot Ciccarelli, would put extra “…operating pressures for a longer period of time (on the company) as other (distribution centers) are forced to pick up the lost capacity.”

Insult to Injury

The news of Dollar Tree’s supply chain devastation came at an odd time for the company, as it started raising prices on several of its items. In fact, a recent study found that there were actually better buys at Costco (NASDAQ:COST) than at Dollar Tree for at least seven products, including pancake mix, canned diced tomatoes, and paper plates.

Now, with Dollar Tree’s supply chain nearly decimated, those price hikes might actually go farther, prompting competitors to step in and take advantage. Interestingly, this revelation isn’t doing Costco much good, as its own shares are down fractionally in the session.

Is Dollar Tree Stock a Good Buy?

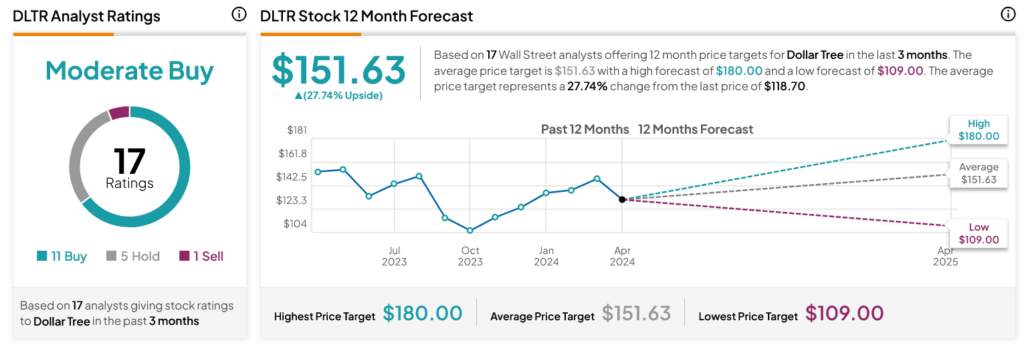

Turning to Wall Street, analysts have a Moderate Buy consensus rating on DLTR stock based on 11 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 22.79% loss in its share price over the past year, the average DLTR price target of $151.63 per share implies 27.74% upside potential.